All Indonesian citizens or companies established and domiciled in Indonesia.

We provide financing facilities for business purposes such as renovating business premises, purchasing machineries, and expanding business volume through our Investment or Working Capital financing facilities. We also provide financing facilities for consumptive purposes such as purchasing residential houses, personal cars and other personal needs through our Multipurpose financing facilities.

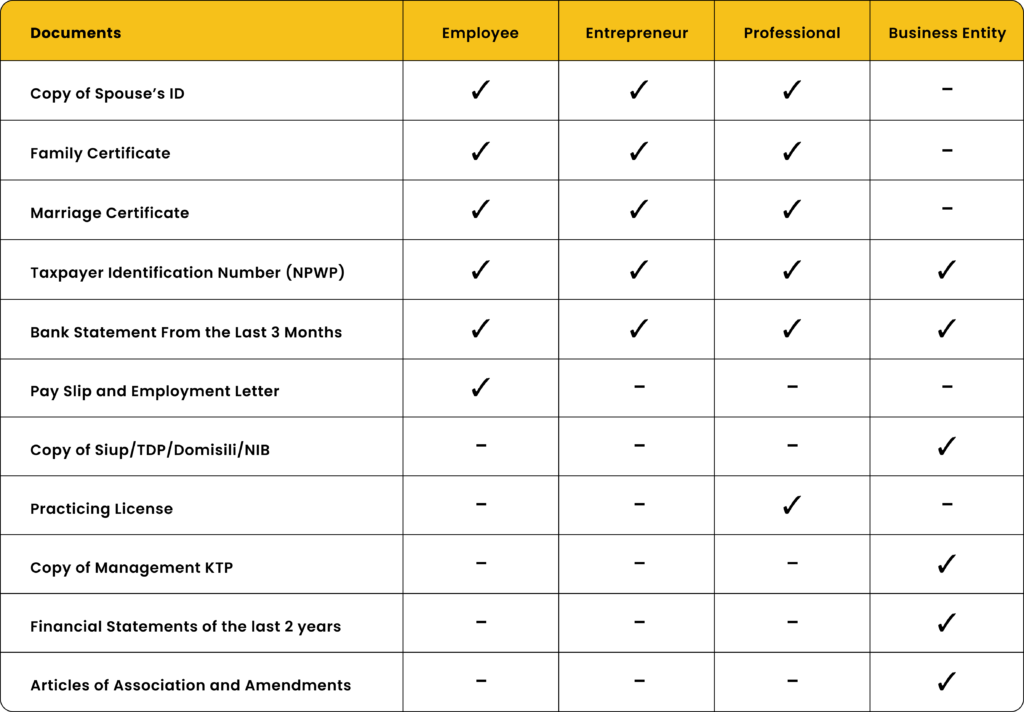

Criteria for prospective borrowers including the administrative requirements can be viewed in the above table on this page.

After all of administrative requirements are submitted, the decision from Proline Finance Indonesia will be made within 7 (seven) working days.

Interest rates are evaluated periodically according to market conditions and also in a case-by-case basis. We aim to provide competitive interest rates for our borrowers.

A competitive provision and administrative fees are charged upfront similar to other financial instutions.

It is recommended that you apply as each financial institution have different policies and criteria.

Please reach us through our Contact Us page or altenatively through the following telephone numbers (021) 514 01260 / 0851 1763 0552